![]() Gs1 Standard in cross border trade facilitation

Gs1 Standard in cross border trade facilitation

|

Gs1 Standard in cross border trade facilitation |

ماهنامه شماره6(بهمن ماه 1394)

1- Introduction

International trade has become more global, with developing, emerging and transition economies connecting with international supply and value chains in terms of both their exports and imports. The worldwide distribution and sourcing cycles, along with just-in-time and just-in-sequence logistics services and the emergence of e-business, has created pressure on governments to ensure efficient, fast and reliable border crossing and clearance procedures. Governments started to realize that their export economies heavily depend on efficient import processing, hence the need to have a holistic approach for a more efficient management of end-to-end trade transactions. Lack of transparency about rules and regulations, redundant and lengthy clearance processes, and multiple documents requirements in different formats and with different data elements, increase the costs and time of doing trade.

GS1 Standards can contribute to Customs’ role to secure the trade supply chain, protect society, facilitate international trade, and increase the efficiency and predict ability of Customs procedures at national borders.

GS1 Standards include an array of Identification (ID) Keys: special numbering systems used by tens of thousands of manufacturers, producers, retailers, logistics companies and other businesses around the world. GS1 ID Keys help clearly identify items, locations, and logistics units; and connect these physical things and logical things to information or business messages related to them.

In this article, first trade facilitation and border procedure regulatory requirements are discussed and then GS1 standards and GS1 initiatives are explained.

2- Trade Facilitation

Trade facilitation is a concept which considers how procedures and controls governing the movement of goods across national borders can be improved to reduce associated cost burdens and maximise efficiency while safeguarding legitimate regulatory objectives. It has recently received considerable attention in the context of security, trade policy, development and customs modernisation programmes.

Trade facilitation can be defined as the simplification and harmonisation of international trade procedures including import and export procedures. Procedures in this context largely refer as “the activities (practices and formalities) involved in collecting, presenting, communicating and processing the data required for movement of goods in international trade”.

Trade facilitation has emerged as a key factor for international trade efficiency and the economic development of countries. This is due to its impact on competitiveness and market integration and its increasing importance in attracting direct foreign investments.

The primary goal of trade facilitation is to help make trade across borders (imports and exports) faster, and cheaper and more predictable, whilst ensuring its safety and security. In terms of focus, it is about simplifying and harmonizing formalities, procedures, and the related exchange of information and documents between the various partners in the supply chain.

2-1- What does it involve?

Figure 1: Trade Failitation Principles

Figure 1: Trade Failitation Principles

2-1-1- Transparency within government promotes openness and accountability of a government’s and administration’s actions. It entails disclosure of information in a way that the public can readily access and use it. This information may include laws, regulations and administrative decisions of general application, budgets, procurement decisions and meetings. Regulatory information should be published and disseminated, when possible, prior to enforcement to allow parties concerned to take note of it and make necessary changes. Furthermore, relevant stakeholders and the general public should be invited to participate in the legislative process, by providing their views and perspectives on proposed laws prior to enactment.

2-1-2- Simplification is the process of eliminating all unnecessary elements and duplications in trade formalities, processes and procedures. It should be based on an analysis of the current, “As-Is”, situation.

2-1-3- Harmonization is the alignment of national procedures, operations and documents with international conventions, standards and practices. It can come from adopting and implementing the same standards as partner countries, either as part of a regional integration process or as a result of business decisions.

2-1-4- Standardization is the process of developing formats for practices and procedures, documents and information internationally agreed by various parties. Standards are then used to align and, eventually, harmonize practices and methods.

3- Border procedure management

Border procedure management is the process that aims to ensure companies comply with regulatory requirements of countries they are exporting to or importing from in the most cost effective manner, while following all procedures and providing the correct information to authorities.

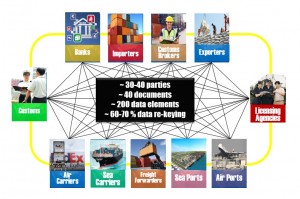

Parties involved in Border Procedure Management can be grouped as follows:

1- Exporters such as manufacturers, traders, growers and material suppliers;

2- Importers such as retailers, distributors, manufacturers;

3-Logistic Services Providers (LSPs) including freight forwarders, carriers, clearing agents / customs brokers, terminal/depot/warehouse operators; and

4- Authorities such as customs and other government agencies (OGAs).

Figure 2: Border Procedure Management – Actors

Figure 2: Border Procedure Management – Actors

Border procedure management can be divided in three main processes:

Figure 3: Border procedure Management- the three main process

Figure 3: Border procedure Management- the three main process

3-1- Compliance rules management

Compliance rules management is the process that aims to ensure companies have all required information to comply with regulatory requirements of countries they are exporting to or importing from in the most cost effective manner, taking into account the type or category of product.

Companies are seeking to increase automation of their compliance rules management process by deploying compliance automation tools. However, significant differences exist between countries that leads to complexities when automating. Examples of rules that cause such complexities are the customs declaration number in Russia (also known as GTD) and the nota fiscal number in Brazil.

3-2- Declaration and documentation management

The declaration & documentation process helps to ensure a company submits high quality data and documentation to customs and OGAs in a timely manner.

Companies can submit these declarations in various ways. Often OGAs will have a web-portal or offer an EDI interface. In some countries OGAs are cooperating and provide a single-window.

3-3- Tracking and inspection

The tracking & inspection process helps to ensure that companies have timely information on goods movements, provide timely information needed for inspections in the field (touch points), and have access to information on border procedure status of shipments.

4-Border procedure regulatory requirements

When goods need to cross borders, a wide range of documentary and procedural regulatory requirements and trade facilitation measures apply. These regulatory requirements and measures are undergoing significant changes because of various underlying issues and drivers:

National sovereignty is shifting to multi-national or even global protocols, changing existing regulatory and process requirements.

Free Trade Agreements (FTA) at a bilateral or multilateral level are having a major impact on customs procedures.

With the growth of electronic trade and electronic data exchange, physical borders are transforming into virtual borders, requiring different types of regulatory controls.

Cross border internet purchasing has caused the volume of small shipments to explode worldwide, adding extra complexity to the role of border management.

Additionally, internet purchasing has created some very real consumption tax collection challenges as consumers exploit the ‘arbitrage’ of differing value-added tax (VAT) and goods and services tax (GST) regimes.

From a business perspective, border procedure regulatory requirements may exist related to Import, Transit, Export and Product Safety Compliance. Furthermore companies should be aware of any trade facilitation measures they may be able to benefit from.

Figure 4: Border procedure regulatory requirements

Figure 4: Border procedure regulatory requirements

4-1- Trade facilitation measures

Trade facilitation topics can be seen in the following diagram.

4-1-1- Bali Trade Facilitation Agreement

The December 2013 Agreement on Trade Facilitation in Bali breathed new life into the WTO. The document makes it plain that trade facilitation is, first and foremost, a matter of customs modernization and simplification so that border regulatory procedures do not hinder legitimate trade. Trade Ministers in all parts of the world will be well aware of this and consequently, customs administrations shall be at the forefront of activity as WTO members seek to ensure that they are following the directives of the Bali agreement. Customs modernization is of vital importance to all stakeholders in trade facilitation – this includes the majority of GS1 members, especially those involved in cross border trade.

The Trade Facilitation Agreement contains provisions for expediting the movement, release and clearance of goods, including goods in transit. It also sets out measures for effective cooperation between customs and other appropriate authorities on trade facilitation and customs compliance issues.

Note: The Bali agreement provides the opportunity to discuss the value of GS1 Standards as a contributing factor to trade facilitation – B2B supply chain standards leveraged for Business to Customs and B2G purposes.

4-1-2- Authorized economic operator (AEO) / Trusted trader programs (TTP)

Authorised Economic Operators (AEO, C-TPAT in the US, trusted trader in some countries including Australia) are actors in the international supply chain (traders, forwarders, brokers, transport companies etc.) with a proven record of compliance who are certified by customs to qualify for certain agreed premium procedures – this might include duty deferral, monthly returns (instead of transactional reporting), fewer inspections, more rapid return to normal processing during trade disruptions etc.

The benefits for both customs and the commercial sector are clear, at least in theory. Full benefits cannot be achieved, particularly for trans-national companies, unless countries have mutual recognition arrangements for their respective AEO schemes. Many significant MR arrangements have been put in place, including EU-US, EU-China and EU-Japan.

Note: There are moves in some countries to investigate how a company might enhance its position to be accepted in an AEO scheme through its adherence to GS1 global standards.

4-1-3-Single window

The international trade single window is defined as a single point at which all government data related to a trade transaction can be received and from which it can be disseminated.

The central driver for single trade window projects is the need to reduce administrative costs for government as well as for traders. The sharing of services, assets, personnel and, critically, lowering the complexity of data are essential.

There are a tremendous number of other factors to be considered in setting up a single window, but the essence of the concept is very simple. Why should the commercial actors in trade need to put the same data into a very large potential number of different formats depending on the border regulatory agency with which they are dealing? Almost all licences, certificates, permits and customs declarations inherit the same data from invoices, manifests and other commercial documents. There is no reason why today’s IT environment cannot make it relatively simple to provide that data once only in an agreed standard format in order to satisfy all government requirements.

4-1-3-1-WCO Data Model

The WCO Data Model is a global data standard that enables single window development. It contains the various data structures and EDI/xml messages that cater for the great majority of exchanges between trade and the many government regulators operating at the border. It is fully aligned with the relevant UN standards and work continues at global level to have it fully aligned with GS1 data and messaging standards as well.

4-1-4- SAFE

The WCO produced a comprehensive supply chain facilitation and security standard called SAFE, in 2005. There are two foundational pillars: 1. customs to customs cooperation internationally and 2, customs to trade partnership.

The customs to customs pillar implies better coordination of procedures, information management and risk assessment between countries and a greater focus on export controls. It is built around the concepts of advanced electronic data for early risk assessment and a legally enabling environment for such cooperation.

The customs to trade partnership pillar is built around the AEO concept mentioned above. The SAFE Framework is not a binding convention; nonetheless, the great majority of WCO Member countries are working towards the implementation of its provisions.

5- GS1 Standards in Cross Border Trade Facilitation

Today traders and border protection agencies are tightly interconnected and need to speak the same language. GS1 standards, as a global language of business, are already widely used by the most well-known manufacturers, retailers, and logistics firms, the same companies that border protection and control agencies interacts with. In other words, GS1’s biggest users are also Governments’ biggest users.

GS1 standards can help make trade and customs operations safer and more efficient because:

GS1 Standards are global, proven, time-tested and trusted by businesses across 150 countries for its user-driven approach to collaborative work.

GS1 Standards create the possibility of a simple and immediate “single window”. A submission (e.g.: Customs declaration) can be easily accessed by multiple parties (e.g.: ministry of agriculture, tax & duties department etc.)

GS1 Standards are neutral and non-proprietary. Other so-called “standards” proposed by ‘for-profit’ companies may have hidden strategies to lock customers into proprietary technology to ensure continual revenue generation down the line.

GS1 Standards are already widely used by the most well-known manufacturers, retailers and logistics firms – the same companies that the WCO has identified as Authorized Economic Operators (AEOs). In other words, our biggest users are also your biggest users.

GS1 Identification Keys such as the GSIN are allocated to transport units early in the Supply Chain process, usually right after manufacturing or during the packaging process; as a result they can serve as the “passport” for a shipment, identifying a transport unit during its entire life cycle.

GS1 Standards are entirely bearer-independent and works with both barcodes and RFID tags.

GS1 Standards open the door to a wide variety of traceability applications, which themselves contribute to border security and anti-fraud applications.

5-1- GS1 Global System of Standards

The GS1 system architecture is based on three concepts that are linked to each other:

Standards to “identify” entities in electronic information that can be stored and communicated between trading partners.

Standards to automatically “capture” data that is carried directly on physical objects (bridging the physical world with the world of electronic information).

Standards to “share” information, both between trading partners and internally, providing the foundation for electronic business transactions and visibility – knowing exactly where things are at any point in time, or where they have been, and why.

Figure 6: GS1 system of standards

Figure 6: GS1 system of standards

Although GS1 offers a comprehensive set of standards, including standards for electronic communication, it is very well possible to leverage the identification and capture standards utilized by companies in combination with customs / OGA standards and solutions. One such example is the support for GS1 keys in the WCO data model.

5-2- GS1 Identification Keys

GS1 Identification Keys are unique identifiers that provide companies with efficient and precise ways to access information about their supply chain entities, and provide this same information to their global trading partners.

GS1 keys deliver value to companies by providing secure and portable identifiers for all entities involved in their supply chains: locations, products, cases, pallets, assets, logistics units, documents and more. And when the identification data is automatically captured and shared with trading partners, GS1 keys enable companies to seamlessly connect the physical flow of products to the products’ information, leading to increased visibility of the products as they travel through the supply chain.

The global uniqueness of GS1 keys makes them especially suitable as identification and reference mechanisms in an international context, enabling interoperability across systems of importers, exporters, logistic service providers, clearing agents, customs agencies and OGAs.

GS1 keys can help to enhance data quality in declarations and documentation, since they correspond with electronic records in databases that can be used to verify information. This also increases transparency and trust, which will help traders to qualify for trusted trader programs.

GS1 keys also add value when tracking and inspecting goods in transport. Scanning a barcode will ease access to related information during inspection, and also will enable the efficient recording of structured data on border procedure related events to enable status monitoring.

One important aspect of the GS1 keys is that they can be used to associate objects with each other, for example which products are contained in a package, which packages are contained in a container, and which packages belong to the same shipment.

5-3- GS1 initiatives

While regulatory requirement pressures are increasing, at the same time authorities are trying to make it easier for companies by leveraging data standards that are already being utilized by the companies. GS1, as representative of a large number of industries, can help their member companies by promoting the GS1 standards already in use. Adoption / recognition of the GS1 identification standards should be the primary goal.

In this chapter we provide an overview of initiatives developed by GS1 organisations around the world.

5-3-1- Unique Consignment Reference (GS1 GO & WCO)

From 2005 to 2006, the GS1 Serial Shipping Container Code (SSCC) was tested for use by the UK and Australian Customs administrations as a Unique Consignment Reference (UCR) – a standard way of identifying unique shipments for effective risk assessment and audit-based controls. This was the first joint effort between GS1, customs and trade to address issues of supply chain security and trade facilitation.

As a follow-on from this pilot, work was launched to develop a new GS1 identifier − the Global Shipment Identification Number (GSIN) − with the aim of fulfilling the requirements of the UCR, which could be used by customs to identify shipments subject to import or export processes.

In 2010, GS1 completed work and ratified the GSIN that is fully compliant with the ISO/IEC standard 15459 and, as a direct consequence, with the UCR concept specified by the WCO.

5-3-2. Anti-counterfeiting (GS1 Global Office, GS1 France & WCO)

The WCO has introduced a training and education tool on counterfeit techniques and other intelligence called IPM (Interface Public Members). GS1 and WCO added an addendum to the 2007 MoU between the two organisations in recognition of the importance of anti-counterfeiting action to both. Of all the areas of border risk, this is one that has perhaps the greatest potential for reaping rewards for both GS1 and customs if the various instruments and standards utilized by GS1 members can help to stem the flood of counterfeit goods.

The IPM provides the possibility to use mobile devices to scan GS1 barcodes found on millions of products. The GTIN embedded in the GS1 barcode facilitates access to multiple databases providing trusted sources of product information.

5-3-3- Product information (GS1 US – PIC / ITDS)

When it comes to product clearances at U.S. borders, three OGAs – the USDA, Consumer Product Safety Commission, and FDA – all share a similar interest in efficiently facilitating trade while ensuring citizens and the environment are not harmed by products admitted at U.S. borders.

The U.S. International Trade Data System (ITDS) is tackling this problem on behalf of all U.S. OGAs. In 2008, the ITDS Product Information Committee (PIC) was established to recommend and implement new strategies for improved product visibility. Over the past three years, the PIC has identified uses for global standards, and in particular, the GS1 GTIN, that if adopted by governments and industry, could provide the missing product information that OGAs need to modernize and expedite product admission at U.S. borders.

Working with Hasbro, a global importer of toys and games, the PIC examined the use of GTINs and GPC codes in consumer goods importing. The findings projected that product examinations could be reduced by 80% in the first year alone with a Return on Investment (ROI) rate of 8 to 1.

Another pilot with the Association of Floral Importers of Florida showed the use of United Nations Standard Products and Services Codes® (UNSPSC®) codes could reduce the average time required to inspect flower shipments by 50% with an ROI of 7 to 1.

A third pilot with Tyson Foods, a U.S. major meat supplier demonstrated that connections to global, standard product catalogues could be created and cost effectively used to manage exports of complex products, saving exporters $1.6 million over the first five years.

5-3-4- Single window initiative (GS1 Canada)

Canada and the U.S. represent one of the world’s largest commercial trade relationships with $1.6 billion worth of goods and services crossing the Canadian and U.S. border every day.1 In December 2011, the Canadian and U.S. governments announced the Beyond the Border Action Plan, which includes a commitment to enable and align the Single Window Initiative (SWI) on both sides of the border. Like the ITDS, the SWI is a joint initiative led by the Canada Border Services Agency (CBSA) in collaboration with ten other PGAs to streamline import requirements by facilitating exchange of commercial import data electronically.

As of December 2013, the Canadian Border Services Agency began receiving and storing the Integrated Import Declaration (IID) from, and sharing relevant data with, the following participating government departments and agencies in a test environment: Health Canada, Canadian Food Inspection Agency, Department of Foreign Affairs and International Trade, Transport Canada and Natural Resources Canada. In Fall 2014, the Canadian Border Services Agency started to use the IID as an electronic importation reporting tool between all nine participating government departments and agencies and the trade community for regulated commercial imports. GTIN will be utilized as a goods/commodity identifier as part of a pilot study in 2015 between GS1 Canada and the Canadian regulatory agencies.

5-3-5- Single-trade window (GS1 New Zealand)

New Zealand expects greater pressures on border services over the next 10 years with increasing trade volumes. Like many, the Government of New Zealand looks to its agencies for improved productivity and collaboration, including Customs. The Customs organisation is extremely focused on industry with its key principles centred on trade management and efficiency.

As a “trusted trader” of the U.S., New Zealand is also very motivated to keep its status through continual monitoring and enhancement of security-related measures. New Zealand Customs, the Ministry of Primary Industries, and industry are all working together to implement a Joint Border Management System (JBMS) that aligns with the “light touch – high assurance” guiding principles of trade management.

With the JBMS, the New Zealand Customs organisation is the first to have truly implemented the WCO Data Model, version 3.0 as the “single-trade window.” Mostly for imports, traders can interface with Customs directly; for example, small businesses will have a web-based interface to upload relevant documents. (The export market is targeted for implementation in the near future.)

Customs has identified GS1 Standards as important to support within the JBMS, and GS1 New Zealand is regarded as a strategic partner. While the use of GS1 standards will not be mandated, they are supported by the JBMS based on the expected value they deliver for more complete and high-quality data. Customs believes this will help with border requirements for advance advice, and therefore help speed goods through the border. The use of standards will also help minimize corruption.

Businesses hearing about the new trade management system have been “extremely excited” about the potential efficiency gains and reduced costs, especially for large businesses where Customs brokers will no longer be needed.

5-3-6- Single window / uCustoms (GS1 Malaysia)

In Malaysia, exports constitute 80% of the country’s GDP. To remain competitive, exporters must deliver “just in time” based on tight order fulfilment intervals. As a result, highly efficient trade facilitation is needed at Malaysian borders. Any delay in the export and import of goods impacts Malaysian businesses’ credibility and excellent reputations in providing timely delivery of finished goods to customers.

To meet these challenges, Customs is working closely with industry stakeholders, including the Federation of Malaysian Manufacturers (FMM) and GS1 Malaysia, to improve the existing Single Window (uCustoms). By implementing an automated single window process, Customs is gaining visibility, focusing its attention on high-risk cargo. With the transparency of automated Customs Procedure Management, decreased human intervention is expected, resulting in lower costs and shrinkage.

Customs recognises large, multi-national companies that qualify as Authorized Economic Operators (AEOs) – businesses that demonstrate a commitment to security and meet criteria specified by Customs for a simplified and rapid product clearance process. As a large number of FMM members are small and medium enterprises (SMEs), FMM is working with Customs to establish a similar facility for SMEs called the Trusted Economic Operator (TEO) program.

GS1 Malaysia has been in discussion with Malaysian customs risk management unit and presented the potential benefits of integrating data fields for GS1 identifiers in the new customs system called u-customs which is currently being developed. Following initial discussions Malaysian customs deferred GS1 to instead discuss directly with the other government agencies (OGAs) that would be benefiting from the integration of GS1 in the new customs systems. Engagement with OGAs related to the cross-border procedures is still being developed.

5-3-7- AEO and single window (GS1 Hong Kong)

Hong Kong is the largest trans-shipment market in the world where bulk containers are re-consolidated and re-packed for shipment. It is also a tax-free zone where HS Codes are used only for statistical purposes and not for tax collection.

Top priorities for Hong Kong Customs include trade facilitation and security with emphasis on anti-counterfeit efforts. Since shipments are becoming increasingly smaller and plentiful, inspecting them is becoming more and more of a challenge, adding up to more time and costs.

Hong Kong Customs is moving to a Single Window automated process, investing in risk assessment of inbound shipments and outbound shipments from China. It has implemented an AEO program with nine organisations joining to-date.

5-3-8- APEC Global Data Standards (GS1 Australia / GS1 Hong Kong)

GS1 Asia-Pacific MOs together with GS1 Global Office are further developing cooperation with the APEC Business Advisory Council (ABAC) to drive the implementation and adoption of Global Data Standards in the Asia-Pacific region, including use of GS1 identifiers for product, trader identification and EPCIS for enhanced supply chain visibility.

Recently a joint project between GS1 Australia and Hong Kong has been launched under the auspices of the APEC Business Advisory Council (ABAC). It seeks to contribute to APEC’s goal of a 10% improvement in trade efficiency by 2015 through the targeting of acknowledged choke points.

The project will help demonstrate the value of using global data standards to increase visibility, security and transparency across international supply chains. It involves a trade lane for wine exportation from Australia to Hong Kong. The two customs administrations involved have exchanged letters of cooperation in this high-profile project.

5-3-9- GLN in phytosanitary and quality certificates (GS1 Netherlands)

In the Netherlands over 1500 growers of fresh produce apply GLNs to comply with quality assurance requirements in the national and international food markets.

For example, the protocol of phytosanitary requirements between Netherlands and China requires for the export of pear fruit from the Netherlands to China that each exported case is labelled with the following origin information:

Region of origin (province, city or country)

Growing location, such as greenhouse, orchard or growing field

Packing location

Cold storage location

These elements enable the importing country to validate the phytosanitary export certificate and the process quality certifications of the grower and the packer.

Supported by Frug I Com (Dutch platform for Fresh Chain Information) and GS1 Netherlands, Dutch growers and traders are implementing GLNs for the identification of their growing, packing and cold storage locations.

The GLN has an important function through its 1-to-1 link to the legal entity, ensuring the legal responsibilities are clear in case of quality issues with shipments. . Each grower can be found via its GLN through the GS1 GEPIR network.

GLOBALG.A.P (organisation for international food quality certification), KCB (the Dutch quality control agency), and QS Fachgesellschaft Obst-Gemüse-Kartoffeln GmbH (German industry-funded initiative for quality assurance in the production and marketing of fruit, vegetables and potatoes) all accept GLNs for the identification of growers, packers and storehouses, including individual locations where required.

The GLN’s are also used in other export applications in the Netherlands. In the Dutch horticultural sector extensive use is made of GLNs, again for product quality assurance requirements in national and export food markets. In fresh produce GLNs are currently being introduced for the export of peppers to China and the export of onions to Indonesia.

In the Netherlands alone the total of GLNs actively used in these sectors is over 30 thousand.

5-3-10- RFID enabled permanent residency cards (GS1 Canada)

The Canadian Border Services Agency has invested in RFID reader technology at border crossings to enable the automated identification of incoming permanent residents. Citizenship and Immigration Canada has purchased a GS1 Prefix to uniquely identify 350,000 to 400,000 new cards a year. The RFID enabled identification documents will be programmed with a Global Document Type Identifier (GDTI) to allow for the globally unique identification of that particular entrant, delivering efficient and effective control and fluidity of cross border entry/exit applications.

6- Conclusion

It is more important than ever to achieve trade facilitation to enhance administrative efficiency and effectiveness, reduce costs and time to markets, and increase predictability in global trade.

The result of adoption of GS1 standards in border trade facilitation can be concluded as the following:

صاحب امتياز

صاحب امتياز